The Covid-19 coronavirus outbreak has caused unprecedented disruption and uncertainty throughout the globe. As the virus spreads, movement and interaction worldwide has already begun to change. To help understand the impact of what’s happened thus far, Factual examined visitation to physical locations in various business categories over the past four weeks, from Feb. 17 through March 15 (using the week of Feb. 17 as a baseline), to help quantify shifts in movement and provide some insight into what’s happening.

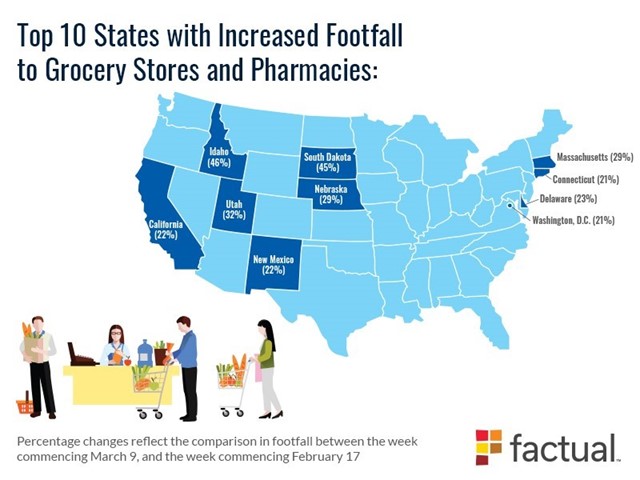

Unless otherwise noted, percentage changes reflect the comparison in footfall between the week commencing March 9, and the week commencing February 17.

Grocery, Pharmacy, and Retail

Nationwide, grocery stores and pharmacies have seen the most dramatic increases in footfall beginning the week of March 9 (12% and 17% respectively). Following the World Health Organization’s declaration of a pandemic on March 11, both grocery stores and pharmacies experienced a 50% increase in footfall compared to the day before the announcement.

Warehouse clubs Costco and Sam’s Club saw the biggest increases in foot traffic (25% and 42%, respectively), while Target, Walmart, CVS, and Walgreens all saw approximately 13% more foot traffic than they did the week of February 17.

Restaurants and Dining

Through March 15, our data showed little decrease in restaurant and bar visitation across the US. However, states that have seen the greatest impact from Covid-19 and have thus implemented stricter sanctions, such as California and Washington, have seen a more drastic drop in footfall. In the chart below, percentage changes reflect the comparison in footfall between the week commencing March 9 and the week commencing February 17.

Our data shows that countries such as Japan and Australia have been experiencing a steady decline in foot traffic to restaurants and bars beginning mid-February, but we are not seeing the same national trend in the US yet. However, we can expect more decline as stricter regulations are implemented across the country.

Travel and Airports

Travel-related movements (including visitation to airports, hotels and tourist attractions) were greatly impacted by the virus and saw a steady decline in foot traffic nationwide starting February 24, though the sharpest declines occurred the week of March 2.

During that time, visits to places in our Travel category were down 6%, and visits to airports were down 9%. This was the week that the US announced an $8.3 billion emergency spending package, high-profile events such as SXSW were beginning to get canceled, and the Grand Princess cruise ship was being held off the coast of California.

Following the announcement of travel restrictions to/from Europe on March 11, however, we are beginning to see an uptick in visitation to airports in the cities, such as San Francisco and Los Angeles, where EU travelers are being routed.

Entertainment

Perhaps almost as hard-hit as the travel industry, places within our Entertainment category (including movie theaters and theme parks) are seeing significant declines in foot traffic globally. As of last week, Japan has seen a 17% decrease in footfall and Australia has seen an 8% decrease.

In the US, foot traffic to these locations have been steadily declining since February 17, with states like California seeing as much as an 18% decline last week. The closure of popular theme parks like Disneyland and Knott’s Berry Farm, announced March 14, likely added to the overall decline. New York and Washington have also seen significant declines (14% and 17%, respectively).

Around The World

We examined visitation data in Australia and Japan to get a sense of how Covid-19 has been affecting other countries around the world. Travel destinations and airports have seen a steady decline in both countries since mid-February, with Japan seeing the most drastic declines.

Interestingly, while Australia, similar to the US, has seen a steady increase in foot traffic to grocery stores and pharmacies, Japan has seen little to no change -- perhaps in part because, of the three countries, it is the only one that has not declared a state of emergency.

When it comes to restaurants and bars, both Australia and Japan have seen steady declines in visitation since mid-February, indicating that the countries likely reacted a bit sooner than the US to social distancing best practices. As of last week, bar visitation was down 7% in Australia and 11% in Japan, and restaurant visitation was down 4% in Australia and 8% in Japan.

As circumstances around Covid-19 continue to change, we will continue to monitor the real-world impact to these and other industries.

Subscribe to:

Post Comments (Atom)

Comments

Post a Comment

Leave a comment. Thanks!

Comentarios de Facebook